Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Understanding the differences between White Label and Public Node delegations.

At Chorus One, we offer tailored staking solutions for various needs, including White Label (WL) and Public Node (PN) delegations.

Both options provide secure and reliable staking services, but each is designed for specific use cases. Below, we will cover the key differences to help you decide which solution aligns best with your staking objectives.

White Label delegations provide you with your own custom validator. This brings a host of benefits such as privacy, personal branding, geo-fencing, control of the commission rate, optional governance participation, and the ability to provide a validator service for your customer base if needed.

Exclusive Branding and Control

Clients can brand and market each WL validator as their own staking service, creating a tailored experience for their audience. Alternatively, clients can keep the validators private for an anonymous service.

Complete Commission Fee Control

You can set and manage fee structures and reward distributions to meet your specific objectives, ensuring maximum flexibility and alignment with your business model.

Direct Governance Participation

With your own validator, you can choose to engage in network governance directly, casting votes and influencing protocol decisions as a unique entity. However, if you would prefer to not participate or outsource this to Chorus One, that is completely fine.

Security and Reliability

White Label delegations benefit from Chorus One’s secure and resilient infrastructure, ensuring reliable performance and robust security for all delegators.

Enhanced Privacy

With White Label validators, you minimize potential attack vectors since they aren’t shared with other clients or involve commingling of funds. Additionally, geographical region selection allows for optimized privacy and regulatory compliance.

Detailed Reporting

For all White Label validators, Chorus One offers comprehensive reporting and support for all contracted customers. The cadence and granularity of the reporting can be tailored to your unique business needs.

Public Node delegations allow multiple clients to delegate to publicly accessible Chorus One validator nodes, optimizing for accessibility and simplicity. For those staking a large amount, please discuss with our Sales Team whether more favorable commission rates may be available for your delegation.

Efficient and Accessible Staking

Public Node delegations offer a user-friendly way to stake without the complexities of setting up a dedicated validator. Clients can delegate their assets and start earning rewards through Chorus One’s infrastructure immediately from a supported custodian or self custodial solution.

There are no token minimums to begin staking.

Lower Operational Costs

By utilizing and existing node managed by Chorus One, Public Node delegations reduce the complexity of staking, making this solution ideal for clients who prioritize simplicity and the ability to hit the ground running.

Security and Reliability

Public Node delegations benefit from Chorus One’s secure and resilient infrastructure, ensuring reliable performance and robust security for all delegators.

Participate in Governance

While Public Node delegators do not participate directly in governance, Chorus One acts as an active, informed participant, ensuring our node supports the best interests, security, and scalability of the network.

Detailed Reporting

For all Chorus One customers whether White Label or Public Node, Chorus One offers comprehensive reporting and support for all contracted customers. The cadence and granularity of the reporting can be tailored to your unique business needs.

If you’re an institution, high-net-worth individual, or enterprise looking for branded staking, control over settings, privacy, customizability, or the ability to provide staking services to your customer base, then a White Label (WL) validator may be right for you.

If you seek an accessible staking solution with a low barrier to entry and reliable returns all backed by Chorus One's robust security model and do not have a unique need for validator-specific settings, then choosing a Public Node (PN) delegation might be most suitable.

For questions or personalized advice on selecting the best staking solution for your needs, please contact our team at or visit our website at .

Here you will find staking adjacent resources such as bridging and swapping via Decentralized Exchanges (DEXs)

You can stake directly to Chorus One using your preferred wallets.

Security

Secure infrastructure managed by Chorus One

Secure infrastructure managed by Chorus One

Cost & Setup

Set up of a separate validator begins once contract agreements are signed and configuration details confirmed with the customer. Additional hardware cost is reflected in the price.

Lower cost and instant delegation available 24/7.

Token Requirements

Customer is responsible for maintaining minimum token balance to keep WL validator in the active set.

No minimum token requirement.

Customizability

Customizable privacy parameters and regions for compliance concerns

Hosted across Chorus One’s infrastructure network

Validator Access

Exclusive to one client or more clients (whitelisted or open)

Shared across multiple clients

Branding

Fully customizable and can be set to be public or private

Standard Chorus One branding

Validator Commission

Full control. Can be set to 100% to deter unknown delegations

Pre-set by Chorus One, but rates negotiable contingent on stake size

Governance Participation

Direct voting access or can be outsourced to Chorus One

Chorus One participates on behalf of delegators

Discover the products from Chorus One that make it easy to provide enterprise-grade staking to both investors and institutions alike.

Chorus One is one of the largest institutional staking providers globally, operating infrastructure for over 30 Proof-of-Stake (PoS) networks, including Ethereum, Cosmos, Solana, Avalanche, Near, and others.

Since 2018, we have been at the forefront of the PoS industry, offering easy-to-use, enterprise-grade staking solutions, conducting industry-leading research, and investing in innovative protocols through Chorus One Ventures.

As an ISO 27001 certified provider, Chorus One also offers slashing and double-signing insurance to its institutional clients. For more information, visit chorus.one or follow us on LinkedIn, X (formerly Twitter), and .

We believe that crypto has the potential to create more freedom, innovation and efficiency.

How to stake any amount of ETH with Chorus One

In three simple steps you can stake any amount of ETH, mint osETH as a liquid staking token and deposit your osETH into Eigenlayer.

Our Stakewise vault allows you to mint osETH, which is a liquid staking token (LST). The issued liquid staking token is overcollateralized, meaning the underlying assets in the vault are worth more than the osETH issued.

For an introduction to Staking Vaults, their benefits for institutions, investors, and use cases, please visit our overview page:

First, access our staking experience:

Stake any amount of ETH via the

Mint osETH from your staked ETH to be used in other DeFi using our

These methods are made as simple as possible to enhance your staking experience, and can be used as described below:

Step 1: Connect your wallet on the page and choose a vault.

You can choose the Chorus One MEV Max vault or the Chorus One Obol DV vault.

Chorus One’s ground-breaking MEV research ensures the highest yields with top-tier security and enterprise-level infrastructure.

If you'd like to take a deep dive, Chorus One's pioneering MEV research led to the design of Adagio an in-house, optimized Ethereum MEV-boost client that increases our MEV rewards by optimizing the way we interact with the transaction supply chain.

In a recent pilot with Adagio were able to generate 4.75% additional MEV rewards.

This vault represents a distributed validator cluster , using Obol's DV technology to run the validators across multiple nodes. As a staker, you can expect higher uptime, decreased slashing risk, and a meaningful contribution to the decentralization of the Ethereum network.

By staking with an Obol DV, you automatically participate in the Obol Contributions initiative, contributing 1% of staking rewards to the "1% for Decentralization" retroactive funding model. Your contributions will be tracked and recognized by Obol and can be viewed on our staking dApp.

Step 2: Select how much ETH you wish to stake, enter the amount, and click 'Confirm and Stake'

At this point, you're now staking your ETH!

However, if you want to restake your ETH in EigenLayer or Symbiotic, read on!

Step 3 (Optional): Mint osETH and deposit it into EigenLayer or Symbiotic.

Once deposited successfully, you can now mint your osETH in 1-click by clicking 'Mint osETH' as shown in the screenshot above.

You can bring your minted on any external platform and deposit them into EigenLayer through

Step 1: Go to the OPUS page, select Restake and connect your wallet

Step 2: Select either EigenLayer or Symbiotic, (shown above) and then select your LRT (i.e. osETH) that you'd like to stake.

Step 3: Deposit your tokens into EigenLayer or Symbiotic.

That's it, you're all done!

You can navigate to the Dashboard on the sidebar at any time to review your staked balances.

Our institutional customers may opt in to leverage the to integrate ETH staking into their offerings, providing their customers with all the benefits of the Chorus One staking experience.

This allows our institutional client’s customers to benefit from all the features offered by ETH Staking Vaults, including no minimum ETH required to stake, top tier-MEV yields, high rewards, and direct restaking with EigenLayer and Symbiotic.

How to view your rewards data in OPUS Pool.

The dashboard view is your one stop shop to view all your staking activity in OPUS Pool.

To navigate there, use the left hand side panel and click on 'Dashboard'

On the left you can see highlighted how to access the dashboard.

Along the top, highlighted in the pink boxes you can see how much your total stake is.

Below this, you can see your total restaked balance highlighted in the box near the middle of the screenshot.

This will show you you what LRTs (Liquid Restaking Tokens) you have restaked.

If you want to check on your Boosted ETH status, this will need to be done via the StakeWise interface to interact with the underlying OPUS Pool Vault.

To learn more, check out

From the dashboard interface, you will see a line graph like the screenshot below.

You can hover your mouse cursor over the graph to see how many rewards you have accumulated over time.

Your Guide to Chorus One ETH staking

Our institutional customers may opt in to leverage the Chorus One SDK to integrate ETH staking into their offerings, providing their customers with all the benefits of Chorus One staking seamlessly.

This allows our institutional client’s customers to benefit from all the features offered, including no minimum ETH required to stake, top tier-MEV yields, high rewards, and direct restaking with EigenLayer and Symbiotic.

Ethereum Proof-of-Stake processing of consensus and building a blockchain is enabled by validators who secure the network by proposing new blocks containing user transactions and attesting to blocks of other validators. For this work, validators are rewarded with ETH.

To create a validator, one needs to call deposit contract with transfer of a minimum amount of 32 ETH, bundling the transfer with a deposit dataset that includes the following:

The validator's public key

Withdrawal credentials

Everything you need to know to stake SOL (Solana) to Chorus One.

Network detail where validator will be running (Mainnet, Gnosis, etc)

A signature proving ownership of the validator's private key

Chorus One Native Staking API for Ethereum provides functionality to generate this data on-demand. The Ethereum client instances corresponding to validators created with this API will be running in Chorus One infrastructure.

To start using API, read our Integration Guide or jump straight to API docs

We can contribute to that ideal by operating reliable and cutting edge infrastructure for decentralized networks.

Published the first study on MEV within a fully decentralized central limit order book, financed by a dYdX grant.

Created a custom fork of the Solana client to capture MEV on Solana.

We continuously adjust our infrastructure and strategies to improve our MEV performance.

To learn more, reach out to us at [email protected]

Double signing protection through database access locks.

Improved key protection through Web3signer Access controls.

Chorus One has attained the coveted ISO 27001:2022 certification ensuring world class security for all customers.

In the unlikely case of a slashing event, our opt-in insurance cover with Nexus Mutual protects all our customers.

All the information you need to stake with Chorus One on a wide variety of networks.

To unstake your staked position, go to the Unstake tab and enter the amount of SOL you would like to unstake and hit the 'Unstake SOL' button.

Once your SOL becomes ready for withdrawal you can click the "Withdraw" button to claim the stake back into your wallet.

If you are an institutional investor looking to stake Solana (SOL) with Chorus One, please reach out to us via our staking request form.

Everything you need to know to stake TON to Chorus One.

First, access our staking experience to stake any amount of TON via the Earn Platform

Step 1: Connect your TON wallet on the page

Step 2: Select how much TON you wish to stake, enter the amount, and click 'Stake TON'. The minimum amount of each stake is 10.2 TON.

Step 3: Sign the transaction from your wallet and you will see a confirmation message

To unstake your staked position, go to the Unstake tab and enter the amount of TON you would like to unstake and hit the 'Unstake TON' button.

Once your TON becomes ready for withdrawal you can click the "Withdraw" button to claim the stake back into your wallet.

If you are an institutional investor looking to stake TON with Chorus One, please reach out to us via our .

A quick overview of how to set up the MetaMask wallet.

MetaMask is a popular non-custodial cryptocurrency wallet and browser extension primarily designed for managing Ethereum-based assets (EVM compatible networks) and interacting with decentralized applications (dApps).

It enables users to securely store, send, and receive Ether (ETH) and ERC-20 tokens while maintaining full control over their private keys.

MetaMask also supports custom networks, including EVM-compatible blockchains like Binance Smart Chain, Polygon, Base, Arbitrum, and many others making it versatile for multi-chain usage.

For the most up to date instructions on installing and setting up your MetaMask wallet, please review the official documentation using the guide below.

If you're using a Ledger hardware wallet, it can easily integrate with MetaMask offerring the security of a hardware wallet with the functionality across multiple chains in the DeFi ecosystem.

For a detailed explanation, please see the following guides from Ledger below.

The guide above from Ledger Academy is a great resource for a deeper dive on using your Ledger to interface with MetaMask, even covering Blind Signing, which will be necessary for some DeFi applications and protocols.

The Ton Rewards API provides reliable access to staking reward data on the TON chain. It enables institutions, custodians, funds, and applications to retrieve daily rewards, vault information, and exportable reports for compliance and performance tracking.

Retrieve accurate staking rewards for Ton addresses

Access Pool-level reward data (Ton Pool)

Generate CSV exports for reporting and reconciliation

Uses Bearer token authentication

Header format: Authorization: Bearer <API_KEY>

Rewards are calculated every validation cycle

Historical backfill available from the date of first stake

The Solana Rewards API provides reliable access to staking reward data on the Solana network. It enables institutions, custodians, funds, and applications to retrieve daily and epoch-based rewards, validator information, and exportable reports for compliance and performance tracking.

Retrieve accurate staking rewards for Solana addresses

Access validator-level reward data

Generate CSV exports for reporting and reconciliation

Uses Bearer token authentication

Header format: Authorization: Bearer <API_KEY>

Rewards are calculated and aligned with Solana epochs

Historical backfill available from the date of first stake

Stay in touch with us via any of our official social platforms.

Tailor the staking experience to your brand. The Chorus One Widget Builder lets you seamlessly apply your own design elements, colors, and style, so the earn section feels fully native to your platform and delivers a consistent, branded user journey.

The Chorus One Widget Builder can be easily accessed at

MEV stands for Maximal Extractable Value. Let's explore what this means for staking.

A quick overview of getting started with Leap.

Leap Wallet is a non-custodial cryptocurrency wallet designed specifically for the Cosmos ecosystem, enabling users to manage, stake, and trade their assets across multiple Cosmos-based blockchains.

It offers a seamless and intuitive interface for interacting with decentralized applications (dApps) and features robust security measures, including full control of private keys.

Leap supports staking directly within the wallet, providing users with easy access to validators and rewards. Additionally, it integrates with popular protocols and block explorers in the Cosmos ecosystem, making it a versatile choice for users looking to manage their Cosmos assets efficiently.

An quick dive into the most important aspect of non-custodial wallets.

A brief overview of different ways your crypto can be stored.

The key difference between custodial and non-custodial wallets lies in who controls the private keys. Custodial wallets are managed by a third party (e.g., qualified custodians or exchanges), which hold your private keys and secure your funds. Self-custodial wallets give you full control of your private keys and assets, making you solely responsible for their security.

While that might make self-custodial wallets sound intimidating with proper security measures you can rest assured your funds are safe.

A quick overview of how to set up and use the Phantom wallet.

A quick help section for next steps on staking to Chorus One using Anchorage.

For assistance with staking through Anchorage and information about supported networks, please contact your dedicated account manager or customer success manager at Chorus One.

Our team will be able to provide detailed guidance and help you navigate the staking processes specific to Anchorage.

A quick overview of how to set up and use a Solflare wallet.

is a non-custodial wallet built for the Solana ecosystem, providing users with a secure and user-friendly way to manage SOL and SPL tokens, interact with DeFi platforms, and stake their assets.

Solflare is also available as a browser extension, mobile app, and web wallet, Solflare offers seamless access to the Solana network with features like in-wallet staking, NFT support, and Ledger integration for enhanced security.

Retrieve accurate staking rewards for Ethereum addresses

Access vault-level reward data (Stakewise V3)

Generate CSV exports for reporting and reconciliation

Uses Bearer token authentication

Header format: Authorization: Bearer <API_KEY>

Rewards are calculated every day

Historical backfill available from the date of first stake

The left sidebar provides all customization options. Changes are applied in real time so you can preview how the Chorus One Widget will appear within your application.

Accent Color

Customize the accent to match with your brand’s primary color.

Color tones can be adjusted directly through a palette, enter a HEX value or RGB values

Brand Logo

Displaying your own logo by updating the URL.

Default: Leave the URL field empty to display no logo.

Networks:

Select the desired networks you want to offer in your platform

Default: All available networks will be shown to users

Referrer Code (optional):

Enter an identifier to track reference across all networks

Prerequisite: Please contact Chorus One team at [email protected] to whitelist your domain.

After customizing the widget to match your branding, you can simply copy the intergration code into your platform by embedding the widget URL inside an <iframe>. The widget is framework-agnostic and works seamlessly across any tech stack, including no-code platforms.

<iframe

src="https://widget-staging.chorus.one/eth/stake?primaryColor=%232a2d2d&bgColor=%23FFFFFF&textColor=%23000000"

width="600"

height="900"

frameborder="0"

></iframe>In the context of Chorus One as a staking provider, our winning MEV strategies help validators optimize their operations and earn greater yield.

By understanding and managing MEV, Chorus One ensures that validators can maximize their earnings while maintaining network integrity and fairness for users.

If you'd like to take a deep dive, Chorus One's pioneering MEV research led to the design of Adagio, an in-house, optimized Ethereum MEV-boost client that increases our MEV rewards by optimizing the way we interact with the transaction supply chain.

In a recent pilot study with Adagio, we were able to generate 4.75% additional MEV rewards on Ethereum.

This ensures that our customers receive optimal MEV yields consistently, rather than solely during periods of high volatility or rare occurrences.

In adherence to transparency principles, our research is entirely accessible to the public on EthResearch.

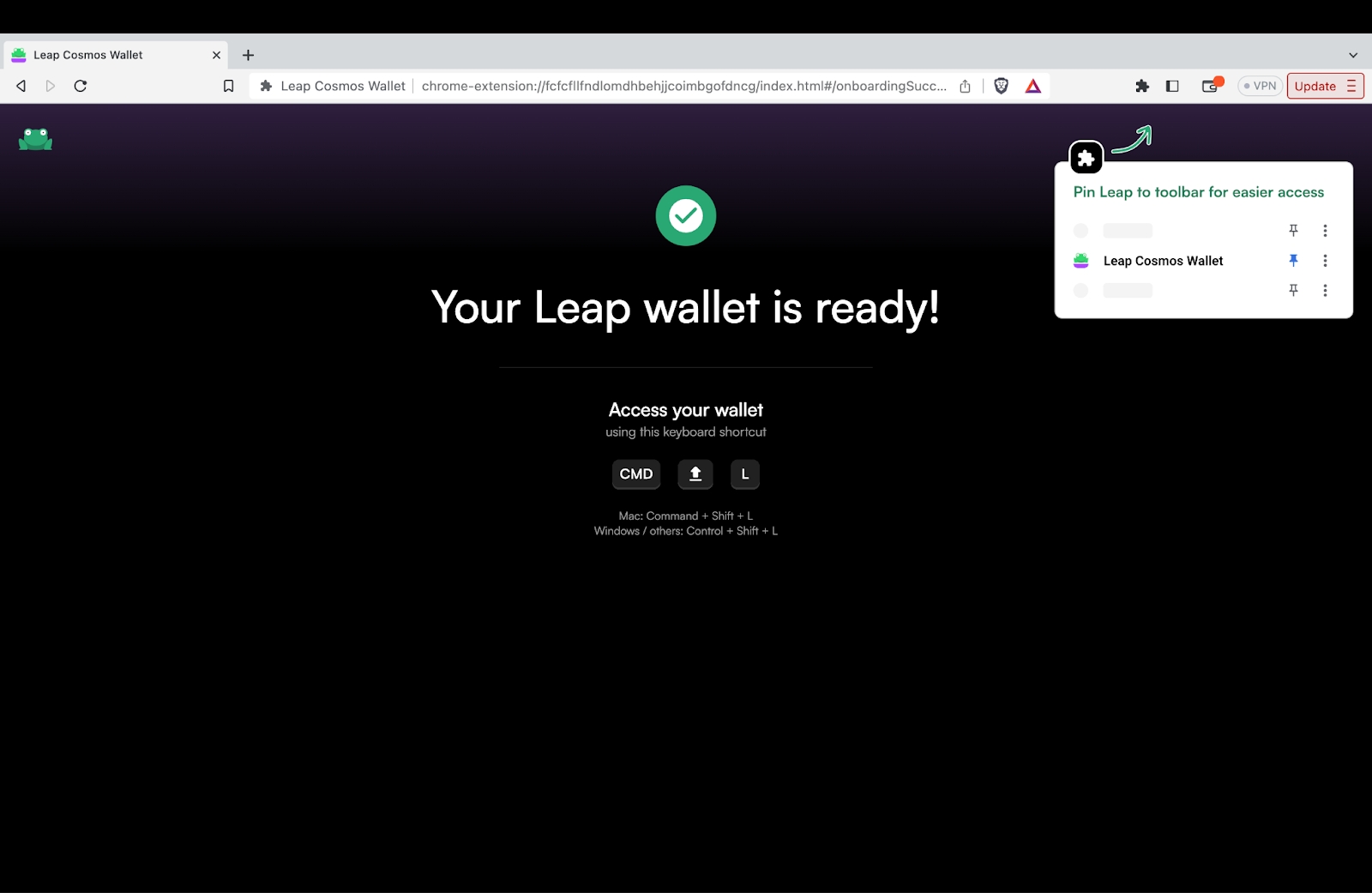

First, download your Leap wallet. You can find their official site here: https://www.leapwallet.io/

For the focus of this guide, we will be covering the Leap wallet browser extension.

Click on the extension in the browser toolbar and the following page will open up.

Once installed, you can create a new wallet, import an existing wallet, or log in with a hardware wallet such as Ledger.

If you choose to create a new wallet you will be shown 12 words as your mnemonic seed.

Please be sure to back up your mnemonic seed securely.

It is recommended to store it physically; never in a digital format or as a screenshot.

Never share this seed phrase with anyone, as they will have access to your funds.

A lost mnemonic seed phrase cannot be recovered.

Anyone with your mnemonic seed phrase can take control of your assets.

You will be asked for the mnemonic again. Enter the 12 words in order and case sensitive (all lower case). This is to make sure you remember the mnemonic and confirm that you wrote it down correctly.

Next, you will be prompted to create a password to secure and lock your wallet when not in use.

After you have set your password your Leap wallet is all set to go!

Click on 'Launch Extension' to begin using your new wallet.

You're all set! Your Leap wallet is up and running and you are ready to send, receive, stake, or interact with the Cosmos DeFi ecosystem.

The terms seed phrase, mnemonic phrase, and recovery phrase are often used interchangeably because they serve the same purpose: enabling wallet recovery.

While the term “12-word phrase” or “24-word phrase” specifically refers to the length of the seed phrase, the underlying function remains the same.

This phrase is a human-readable representation of the cryptographic private keys tied to your wallet.

Seed phrases are typically 12, 18, or 24 words long, derived from a predetermined list of 2,048 words under the BIP-39 standard.

The order of the words in the seed phrase is critical; even a slight deviation renders the phrase invalid. Here's a few quick tips:

The words will always be in lower case.

If you think you may have misspelled a word or written it down incorrectly, you can cross-reference against the .

Your seed phrase acts as the root access (or "master key") for your wallet, allowing you to recover your funds on any compatible wallet if your original device is lost, stolen, or damaged.

For a deeper dive, please see :

Regardless of the terminology, keeping your seed phrase secure and private is essential.

Anyone with access to it can take full control of your funds.

Storing it offline, in a secure location, is strongly recommended to prevent unauthorized access or theft.

Having a backup copy in a geographically dispersed location is also advisable.

Now that we've covered the importance of seed phrases non-custodial wallets, please feel free to read on to the next guide on best security practices when navigating the crypto ecosystem. Whether you're using a custodial or non-custodial solution these practices can help ensure your funds are secure.

A custodial wallet is a type of cryptocurrency wallet where a third party, such as an exchange or service provider, or qualified custodian manages the private keys on your behalf.

This means the provider holds full control over your funds, and you rely on them to secure your assets and enable transactions. Users typically access custodial wallets via a username, password, and potentially additional security measures like two-factor authentication (2FA).

Ease of Use: Custodial wallets are beginner-friendly and offer integrated services like buying, selling, and trading directly within the platform.

No Private Key Management: You don’t need to manage private keys, reducing complexity but requiring trust in the custodian.

Centralized Control: The custodian has control over your funds and can freeze accounts or impose withdrawal limits under suspicious circumstances.

Regulatory Compliance: Your business needs may require the use of a qualified custodian.

A self-custodial wallet gives users full control of their private keys and, by extension, their funds.

These wallets do not involve a third party, meaning you are solely responsible for managing and securing your keys. Self-custodial wallets can be software-based (mobile or desktop apps) or hardware devices (known as hardware wallets) designed to store private keys offline.

Full Control: You are the sole custodian of your funds, with no reliance on third parties.

Private Key Ownership: The wallet generates and stores private keys locally, often represented by a seed phrase for backup.

Decentralized: Self-custodial wallets align with the principles of decentralization, granting autonomy to users.

Integration with dApps: While often possible with custodial solutions, self-custodial wallets are often more readily able to interface with dApps (decentralized applications) in the Web3 ecosystem.

Ownership: Custodial wallets involve a third party holding your keys; self-custodial wallets grant you full ownership of your keys.

Risk Profiles: Custodial wallets carry the risk of hacks or freezes due to centralized management. Self-custodial wallets place the responsibility of security on the user.

Regulatory Compliance: Custodial wallets are sometimes required for regulatory compliance based on your unique business needs.

For urgent queries or emergencies, please create a ticket on our support platform.

General Support: [email protected]

Institutional Staking: [email protected]

Marketing Inquiries: [email protected]

Research Inquiries: [email protected]

Venture Inquiries:

Phantom wallet is available as a browser extension and mobile app, and it provides a streamlined user experience with built-in staking, token swaps, and Ledger integration for added security.

Setting up Phantom is quick and straightforward. You’ll have the option to either create a create a new wallet or import an existing one, securely back up your recovery phrase, and set a password for easy access.

Please reach out to your dedicated account team in your preferred established communications channel.

For urgent queries or emergencies, please create a ticket on our support platform.

General Support: [email protected]

Institutional Staking: [email protected]

Marketing Inquiries: [email protected]

Research Inquiries: [email protected]

Venture Inquiries:

To get started with Solflare, you’ll need to create a new wallet or import an existing one.

This process involves securely backing up your recovery phrase and setting a strong password for access.

ETH staking & restaking for all

Chorus One dApp for Ethereum enables you to seamlessly stake any amount of ETH with Chorus One, and the Chorus One Staking portal allows you to mint osETH and directly deposit supported Liquid Restaking Tokens (LSTs) into EigenLayer as well as Symbiotic in one seamless flow, powered by Stakewise v3

We have expanded the possibilities of ETH staking by extending our MEV optimization strategies beyond a select group of customers to encompass all ETH stakers.

We hold decentralization as a core value, and through our partnership with Stakewise, we take immense pride in making our enterprise staking infrastructure available to everyone - all without any minimum requirements to stake ETH.

Chorus One Staking facilitates greater participation in securing the Ethereum network and also allows a wider range of Chorus One stakers to earn rewards and gain access to a suite of benefits, including top-tier MEV yields, low fees, and the assurance of enterprise-grade security, among others.

By staking your ETH with Chorus One Staking, you can stake amounts of ETH that are not divisible by 32. For example, to run your own ETH validator, you would normally need 32 ETH.

However, if for example have 12 ETH or 46 ETH, you can stake all of it via Chorus One Staking.

Chorus One Staking for Ethereum democratizes access to staking rewards by removing barriers such as minimum staking requirements and the need for technical infrastructure, making it an attractive option for a wider range of investors.

Plus, with the launch of Delegation on Eigenlayer you can now easily delegate your restaked position to Chorus One with a single click of a button.

Liquid staking is a mechanism that enhances traditional staking by introducing liquidity to staked assets. Unlike traditional staking, which necessitates locking up cryptocurrency to support a network’s operations and security, liquid staking allows participants to retain the fluidity of their assets.

Below, we provide a brief breakdown of the various methods available for staking ETH and minting osETH with Chorus One.

Simply put, Chorus One Staking allows anyone to stake any amount of ETH to a pooled staking solution, powered by Stakewise v3 using .

We also have tailor-made for clients seeking individual, personalized agreements for their staked capital.

For a comprehensive understanding of the benefits associated with staking your ETH on Chorus One's liquid staking pools, we've covered all the details .

Chorus One Staking for Ethereum brings in a host of benefits for users. Let’s take a brief look at what you stand to gain.

In addition to the benefits mentioned above, our Institutional clients can leverage the to integrate ETH staking directly into their UI.

This allows you to provide your customers with all the benefits of the Chorus One Staking seamlessly in your platform.

To learn more, please reach out to [email protected]

An overview of the newest developments in crypto staking and how to get involved.

While we covered the overall gist of how staking works in our Staking Overview, there are many nuances and different concepts in the world of staking that vary from network to network.

A consensus mechanism where token holders delegate their staking power to validators who participate in network consensus on their behalf.

Examples:

Networks like Tezos and use DPoS among many others that use either DPoS directly or a combination of this consensus model with new novel models.

Benefits:

Greater scalability and efficiency compared to traditional Proof of Stake (PoS).

Lower barrier to entry for token holders who want to participate in staking.

This is one of the many services Chorus One offers. SaaS involves a trusted third party solution that simplifies the staking process for users or institutions, typically by managing validator infrastructure.

Example:

Chorus One offers staking services for multiple networks, ensuring secure and reliable validator operations.

Benefits:

Reduces technical complexity for stakers.

Provides institutional-grade reliability.

Allows White Label branding and dedicated support for all your staking needs.

Comprehensive rewards reporting directly from Chorus One or via

A penalty imposed on validators (and their delegators) for misbehavior, such as downtime or double-signing blocks. It is the punishment mechanism to ensure and incentivize good behavior on a network for all participants and helps keep the network secure.

A mechanism that automatically reinvests staking rewards into the staked principal, allowing users to earn compound interest without manual intervention.

Not all networks have auto-compounding of staking rewards.

For these networks, it is advisable to find a cadence that works for you to periodically claim and stake the newly earned rewards to maximize your reward potential.

Benefits:

Auto-compounding maximizes yield without additional effort for the user.

This can make networks with this mechanic ideal for long-term stakers.

Staking Pools use a collective staking approach where multiple users combine their tokens to meet the minimum requirements for staking to create accessibility for users who otherwise could not participate and to increase reward efficiency.

Examples:

— By pooling ETH in a custom solution, Chorus One has created an Ethereum staking solution that allows any user to stake any amount of ETH instead of being limited to quantities of 32 ETH.

has a high requirement to stake. By using a STX pool run by Chorus One, users with lower amounts of STX can participate and earn rewards.

Benefits:

Accessibility for for more users leading to more equitable access to rewards potential.

Increased network decentralization.

A staking mechanism that locks liquidity-providing tokens (e.g., LP tokens) in return for network rewards, aligning staking with liquidity provisioning.

Example:

Berachain’s PoL mechanism locks LP tokens in exchange for staking rewards, creating incentives for deep liquidity in its ecosystem.

Benefits:

Encourages liquidity in trading pairs.

Dual rewards from staking and trading fees.

You may have heard the term, but what does it mean? Let's dive in.

When assets are staked, they generally can’t be used for other things. This creates some capital inefficiency.

Enter Liquid Staking, a developing in the staking ecosystem that allows staked assets to be leveraged to earn additional yield.

Liquid staking generally works by creating a smart contract that pools the stakeable asset.

The smart contract then stakes these assets with various providers.

The delegator receives a token that represents a claim on the staked assets. This is a token that can be used and transferred without limitations, opening up new possibilities to leverage your staked assets.

Liquid staking allows quite a few benefits such as:

Selling the staked asset instantly without going through an unbonding or unstaking period.

Use the asset as collateral to borrow against it.

Providing the staked asset as liquidity in exchanges and earning trading fees as well as staking rewards at the same time.

These are only a few examples of what LSTs can do. There are a variety of DeFi platforms out there where users can get creative with how to maximize the utility of their staked assets.

Restaking refers to using already staked assets (or their derivatives) to secure additional networks or participate in other staking mechanisms, effectively “stacking” staking opportunities.

Example:

EigenLayer or Symbiotic enable restaking of staked osETH through to secure new protocols known as AVS's (Actively Validated Services).

Benefits:

Increased capital efficiency.

The Chorus One Widget is a ready to integrate product built on iFrame that can be easily embed into existing website or app, allowing the end users to connect wallet and start earning rewards with Chorus One.

The Widget is built for platforms that want to do more than just offer staking — it’s designed to deliver trusted, institutional-grade staking and rewards with a seamless user experience. Whether you are a wallet, custodian, asset management or trading platform, the widget gives you the tools to engage users, grow loyalty, and unlock monetization — all backed by one of the most established validators in the industry.

Unlike generic earn widgets, the Chorus One Widget combines deep protocol expertise with a fully customizable interface, allowing partners to offer staking solutions that align perfectly with their brand and user base.

With the Chorus One Widget, platforms can:

Launch staking without code: Deliver new staking services instantly, without diverting engineering resources.

Integrate flexibly: Deploy as a branded standalone dApp or embed seamlessly into existing web or mobile applications.

Offer a complete staking journey: From discovering staking opportunities to connecting wallets, depositing assets and monitoring detailed, real-time reward analytics — all in one consistent, transparent experience.

Leverage proven security & credibility: Chorus One secures billions in assets and partners with leading institutions — providing confidence and reliability your users can trust.

By partnering with Chorus One, platforms don’t just add staking — they gain access to world-class infrastructure, deep ecosystem relationships, and the assurance of a specialist who has been at the forefront of staking since day one.

Use the Chorus One Widget Builder to fully align the staking interface with your brand. Apply your own colors, fonts, and logos to deliver a seamless, on-brand user experience.

With support for multiple networks and a wide range of wallets, the Chorus One Widget unlocks diverse staking and yield options — giving your users seamless access to the best earning opportunities in one unified interface.

Integrate staking functionality quickly, even without a dedicated engineering team. The Chorus One Widget is lightweight, framework-agnostic, and can be embedded into any platform — from enterprise systems to no-code tools.

A quick overview on setting up your Petra wallet.

Petra Wallet is a cryptocurrency wallet designed for the Aptos blockchain, which is known for its high performance and scalability. The wallet provides users with a simple and secure way to manage their digital assets, including tokens and NFTs on the Aptos network.

This makes Petra Wallet is a robust choice for those looking to explore or manage assets in the Aptos ecosystem, combining ease of use with strong security measures. Its focus on Aptos-specific functionality makes it a go-to wallet for users of this blockchain.

Browser Extension Wallet

The wallet is available as a browser extension for Chrome and other Chromium-based browsers, allowing for easy integration with dApps and web3 applications.

Aptos Ecosystem Integration

As a native wallet for Aptos, Petra allows seamless interaction with the Aptos blockchain and its decentralized applications (dApps).

Non-Custodial

Users retain full control over their private keys, ensuring that they own and manage their assets independently.

For security tips please see: and

Multi-Asset Support

Petra supports Aptos native tokens as well as other assets built on the network, including NFTs.

For the most up to date instructions on installing Petra wallet, please review the official documentation using the guide below.

Once you have Petra wallet installed, follow the prompts to setup and secure your new wallet.

If you opt to create a new wallet you will next be prompted to set a password to secure your wallet.

Please note: Your password cannot be recovered, however, your seed phrase can always be used to restore your wallet if your password is lost or forgotten.

If you create a new wallet you will next be shown your new seed phrase. Please write this down and store it securely. On the next screen you will be prompted to select one of the seed words in your seed phrase to ensure it was recorded correctly.

After this, you will be prompted to create a Petra name. This can be used in addition to your wallet address.

And that's it, you're done!

Your Petra wallet can now be accessed via your browser toolbar.

A quick overview on setting up your OKX wallet.

OKX Wallet is a versatile, non-custodial cryptocurrency wallet designed for managing assets across multiple blockchains, including Ethereum, Bitcoin, Solana, and other major networks.

It supports a wide range of use cases, such as trading, staking, NFT management, and interacting with decentralized applications (dApps).

The wallet is available as a mobile app, browser extension, and web wallet.

For the most up to date instructions on installing and setting up your OKX wallet, please review the official documentation using the guide below.

A quick overview on setting up your Cosmostation wallet.

Cosmostation is a multi-chain cryptocurrency wallet designed primarily for the Cosmos ecosystem but also supports other blockchain networks. It provides a secure and user-friendly interface for managing tokens, staking, and governance participation.

Multi-Chain Support: Compatible with Cosmos-based networks (e.g., Osmosis, Akash, Juno) and others.

Staking Integration: Allows easy staking and delegation of assets to validators, with tools to monitor rewards.

Governance: Users can vote on proposals directly within the wallet.

Mobile & Desktop Options: Available as a mobile app (iOS/Android) and as a browser extension for desktop.

First download and install the Cosmostation wallet — The browser extension for the wallet can be .

Alternatively, you can follow their official guide below:

Once your wallet is installed you can create and add accounts to handle a variety of IBC compatible networks.

If you create a new wallet you will be shown a new seed phrase. Please write this down and store it securely. On the next screen you will be prompted to enter some of the seed words to ensure it was recorded correctly.

After, you can select what networks you want to use with Cosmostation. A few will be selected by default, however, any additional networks you plan to use can either be found via the search bar or by scrolling through the list.

After you have selected the networks you would like to use, you will be prompted to create a password to protect your wallet.

Please note: Your password cannot be recovered, however, your seed phrase can always be used to restore your wallet if your password is lost or forgotten.

And that's it! you're all set! Once your password has been set, your Cosmostation wallet is ready to use!

If you'd like further instructions or details on setting up your Cosmostation wallet please refer to the official technical docs from Cosmostation.

Everything you need to know to use Fireblocks with Chorus One Staking

In order to integrate Chorus One Staking with Fireblocks, we will be using the built in WalletConnect functionality to gather the information we need to connect your Fireblocks account to .

As a brief overview, is an open-source protocol that enables secure and decentralized connections between various blockchain wallets and dApps (decentralized applications). Users can interact with dApps like OPUS Pool from their mobile wallets to manage and execute transactions without exposing private keys.

is a secure and enterprise-grade platform designed to manage digital assets and crypto transactions, providing solutions for securely transferring, storing, and issuing digital assets, with features like multi-party computation (MPC) and a network of trusted partners.

Everything you need to know to stake Polygon, the Layer 2 scaling solution built on Ethereum.

Polygon (POL) is a decentralized Ethereum scaling platform that aims to improve the scalability and usability of the Ethereum blockchain while maintaining its security and decentralization.

It provides Layer 2 scaling solutions like sidechains, rollups, and plasma chains, enabling faster and cheaper transactions.

Polygon also supports the creation and connection of multiple blockchain networks, enhancing interoperability among different chains. The POL token is used for governance, staking, and paying transaction fees within the Polygon ecosystem

Multi-network staking rewards reporting made simple.

Overview

The Chorus One Rewards is a powerful tool designed to simplify staking rewards reporting across 20+ blockchain networks. It provides granular, accurate, and multi-format data tailored for all kinds of institutions including Asset Management Firms, Custodians, Wallets, Exchanges etc. It is available as a fully functional UI where you can log-in and view your reports. In addition to that, Chorus One Rewards API can be used to integrate reporting capabilities into your own infrastructure.

Chorus One Rewards is built for Finance Managers and Product Operations teams handling staking reconciliations, reporting, and audits. It is ideal for institutions looking for accurate and granular reporting.

Questions and answers to various crypto topics.

A seed phrase, also known as a mnemonic phrase, recovery phrase, or 12, 18, or 24-word phrase, is a set of words generated by your cryptocurrency wallet to serve as a master key to access your funds.

This phrase is a human-readable representation of the cryptographic private keys tied to your wallet.

Seed phrases are typically 12, 18, or 24 words long, derived from a predetermined list of 2,048 words under the BIP-39 standard.

They act as the root access (or "master key") for your wallet, allowing you to recover your funds on any compatible wallet if your original device is lost, stolen, or damaged.

Importantly, the order of the words in the seed phrase is critical; even a slight deviation renders the phrase invalid. The words will always be in lower case.

Regardless of the terminology, keeping your seed phrase secure and private is essential.

Anyone with access to it can take full control of your funds.

Storing it offline, in a secure location, is strongly recommended to prevent unauthorized access or theft.

Having a backup copy in a geographically dispersed location is also advisable.

USDC (Coming Soon)

Monad

Akash

Atom

Axelar

Band

Celestia

dYdX

Kava

Sei

Actively Validated Services (AVSs), essentially are new projects or applications building on Ethereum which can tap into this pool, consuming security based on their needs while validators contribute at their discretion, weighing risks and rewards. This system negates the need for AVSs to establish their own validator networks, instead allowing them to utilize Ethereum’s existing security infrastructure.

For a more comprehensive overview of EigenLayer and how it addresses current challenges in Ethereum security, please read our blog.

osETH, wbETH, rETH, cbETH, stETH, oETH, ankrETH, swETH, ETHx, EIGEN Enhanced security for emerging networks and bootstrapping potential.

Considerations:

However, in some cases this can lead to Increased risks since slashing could impact the same asset across multiple protocols.

LSTs are tokens that represent staked assets in a liquid form. They allow users to continue earning staking rewards while maintaining the flexibility to trade, transfer, or use the tokens in other DeFi applications.

Use Case:

If you stake ETH on a liquid staking platform like OPUS Pool, you receive osETH, which can be used across certain DeFi protocols while your original ETH remains staked.

Alternatively, it can be restaked to a protocol like EigenLayer or Symbiotic.

Benefits:

Liquidity for staked assets.

Access to DeFi opportunities like lending, borrowing, and trading.

Continued earning of staking rewards.

LSDs are a subtype of LSTs that represent not only the staked asset but also the accumulated staking rewards.

This means the value of the LSD increases over time, reflecting both the staked amount and the rewards earned.

Example:

With rETH from Rocket Pool, the token’s value grows as staking rewards are added, eliminating the need for separate reward distribution.

Benefits:

Simplicity in managing staking rewards.

This can be better suited for long-term holding in DeFi strategies.

It can help reduce operational complexities for liquid staking platforms.

Secure Key Management: Supports private key, mnemonic, and Ledger hardware wallet integration for enhanced security.

So how do we get these two interfaces to work together to integrate with OPUS Pool? Read on!

When first landing on the OPUS Pool page, click on the 'Connect wallet' button in the upper-right hand side of your screen.

Next, you will be prompted with a connection method. In this case, we are choosing WalletConnect as illustrated below.

You'll see a screen like the following:

From here, you'll have two options on how to proceed.

1.) Connect to your Fireblocks account via the Fireblocks button.

This can be done via your web browser, however, signing transactions will still be done via Fireblocks on your mobile device.

2.) Connect to OPUS Pool via the Wallet Connect QR code from your Fireblocks account.

This will require the use of a mobile device to access your Fireblocks account. Signing will also take place via your Fireblocks app on your mobile device.

From the WalletConnect popup window we saw before, select the Fireblocks button to the right of the MetaMask and Ledger buttons.

This will open a new browser tab where you will be prompted to first login to your Fireblocks account then connect your Fireblocks vault to OPUS Pool.

You'll see a screen similar to the screenshot below:

Click 'Connect vault' and after some loading time has passed, this window will disappear and you will see something similar to the following in your Fireblocks dashboard.

Next, leave this window open and navigate back to the tab where you have OPUS Pool open in your browser.

Now you should see your wallet connected and you will be ready to stake using the OPUS Pool interface.

If you'd like a refresher on the staking steps for OPUS Pool, please see:

As you go through the staking process, you'll be able to check on the progress of the staking transactions via your Fireblocks account.

For example, you may see statuses such as:

Here's some examples of how this may look in your Fireblocks account.

And you're all set!

You've successfully staked in OPUS Pool via your Fireblocks account.

First, open up your Fireblocks app on your mobile device and select the 'Scan' button. It can be seen just to the left of the gear icon, highlighted in the screenshot below.

All transactions will be finalized and signed via your Fireblocks app on your mobile device.

Next, select the Fireblocks vault you wish to stake from.

Once you've selected your vault, select 'Connect'.

You'll be prompted to confirm the connection. You can do so by pressing on 'Got it'.

Now if you navigate back to OPUS Pool in your browser, you will be able to see your connected Fireblocks wallet.

You can proceed with staking as normal.

If you'd like a refresher on the staking steps for OPUS Pool, please see:

Here's a screenshot example shown below.

Click on 'View' to see the transaction details before you sign it.

If all looks good, tap on 'Approve' to sign and submit the transaction.

After submitting it, you can view your Fireblocks dashboard from either your mobile or web browser interface to review your recent activity.

And that's it!

You've successfully completed a transaction in OPUS Pool using Fireblocks in your mobile app.

CATEGORY

DETAILS

Chorus One Validator Address

0xbbd83024be631bb6f3dd3c0363b3d43b5d91c35f

APR

Block Explorer

Staking Rewards

Unstaking Period

21 Days

Commission

5%

To start staking POL, first log in to https://staking.polygon.technology/ on the browser of your choice.

Please ensure that the browser has integrated any of the wallets supported by Polygon.

Then, click on Login and connect to the wallet of your choice.

Click ‘View all’ to see all the wallets supported by Polygon. We have chosen MetaMask.

Once you have connected your wallet, click on ‘Become a Delegator’, and search for ‘Chorus One’ amongst the list of available validators.

Click on ‘Chorus One’ to verify all the details. Ensure that the Validator address (shown as ‘Owner’) is:

0xbbd83024be631bb6f3dd3c0363b3d43b5d91c35f

Once you have verified all the details, click ‘Become a Delegator’.

Next, enter the amount of POL you would like to stake. Then, click ‘Continue’.

You will be redirected to your wallet to approve the transaction, which can take up to a few minutes.

You have now completed the process and staked your POL with Chorus One!

If you are an institutional investor looking to stake Polygon (POL) with Chorus One, please reach out to us via our staking request form.

Yes. Please contact your Chorus One representative for details or email us at [email protected] or [email protected].

Chorus One Rewards offers many benefits for users, allowing it to stand out as a unique accounting and reporting solution.

Supports 20+ blockchain networks, including Ethereum, Solana, and Celestia.

Provides daily reports with historical stake, ARR, commissions, and transaction events.

Includes point-in-time USD values and an aggregate view of stake across chains.

Features a simple, user-friendly interface and one-click Excel downloads.

Easy integration using API

Historical rewards and stake

Transaction events (such as Delegate, Undelegate, Claim Rewards etc.)

Daily (annualized) ARR

Aggregated and chain-specific staking data.

Yes, reporting APIs are available to enable automated integrations for reconciliation and reporting.

Yes, we support data exports to to CSV and Excel formats, allowing you to filter by address, month, and more.

Currently, yes! However, in the future, we will support any address, regardless of whether it’s staked with Chorus One or other validators.

Yes, you can choose which columns to display and sort the data by date, amounts etc. as per your needs.

The platform is designed to scale, supporting hundreds of addresses.

Chorus One Rewards supports historical stake, rewards and transaction data. We have imposed the start date as of January 1st, 2024.

In case, you need older snapshots, just let us know!

At the moment, DeFi rewards are not visible. However, we are working towards showing rewards segregated by different types, including by MEV (e.g. on Ethereum) rewards.

We employ multiple layers of data validation to ensure high data quality and accuracy.

If you stake with Chorus One, you automatically get access to Chorus One Rewards.

Share with us the email you would like to whitelist.

Login with that email.

You’ll receive a magic link.

You’re ready to log in!

Akash

Aleo

Axelar

Celestia

Cosmos

dYdX

Ethereum (Stakewise)

Injective

Oasis

Osmosis

Persistence

Seda

Sei

Solana

Ton

Avalanche

Polygon

For additional support, please contact your Chorus One representative or email us at [email protected] or [email protected]

A comprehensive overview of StakeWise V3

Jordan Sutcliffe, Head of Business Development at Stakewise, aptly coined StakeWise V3 as the ‘Swiss army knife’ for ETH staking, sparking a flurry of interest from ETH enthusiasts. During the unveiling, the team revealed that the new version opens the doors for anyone capable of running Ethereum validators to engage in liquid staking and receive delegations in a permissionless manner.

This is an approach that aims to welcome a broader range of participants, fostering control and driving decentralization within the Ethereum staking ecosystem.

Delegate ETH to a vault of the node operator(s) of their liking (1st layer)

Giving them the option to mint osETH to represent their stake (2nd layer)

This design enables anyone to join as a solo staker who can mint osETH tokens against their node, or delegate ETH across multiple nodes to counteract network concentration.

Notably, StakeWise v3 introduces a slashing-resistant staked ETH token, osETH, ensuring scalability without introducing systemic risk to the broader ecosystem.

Ethereum was conceived with the mission of building a permissionless, censorship-resistant and financially robust network for value exchange.

The transition to Proof of Stake (PoS) through the Merge aimed to democratize participation, shedding the hardware and compute costs of Proof of Work (PoW). A year on from the Merge, however, centralization remains one of Ethereum’s biggest challenges - ironically, drifting towards the paradox of its own mission statement.

Staking on Ethereum had previously mandated validators to lock up 32 ETH with the network. While this investment yields interest, any misstep or dishonest conduct by a validator can lead to the revocation of funds. Setting up a validator node to stake on the network can also be a complicated task, meaning financial penalties can result if things are set up improperly.

This innovation democratized ETH staking, allowing nearly anyone to participate. Intermediaries assumed the operational responsibilities, handling the pooling, staking, and technical requirements, while taking a share of the rewards for their efforts.

The drawback of the pre-existing version of StakeWise and its counterparts is simple but crucial.

The absence of technical or capital requirements, the ability to temporarily exit from staking, and the increased efficiency of staked capital presented by liquid staking protocols resonate with depositors to an extent that it leads to a decrease in solo stakers (for example, individuals setting up ETH validators at home).

Over time, this decline can significantly impact Ethereum’s security and decentralization.

To address this, the StakeWise DAO introduced StakeWise V3, its latest version that allows anyone from solo stakers to established node operators to financial institutions to participate.

As a solo staker, one can seamlessly launch their own nodes, mint staked ETH (osETH) tokens against their nodes, or delegate any amount of ETH across multiple nodes to counteract network concentration.

At the heart of StakeWise V3 are ‘Vaults’ - a network of permissionless, non-custodial staking mini pools that anyone can launch on the and receive ETH delegations on their nodes.

StakeWise vaults offer the user freedom to stake with whichever vault they want, choosing between vaults run by solo stakers, node operator companies, and groups of solo/commercial operators.

For every 32 ETH of deposits accumulated in a Vault, the Vault operator(s) registers an Ethereum validator in the Beacon Chain and starts staking. The staking rewards belong to the depositors, net of the staking fee charged by the Vault.

Importantly, each of these Vaults is completely unique to the configurations set up by its operator, meaning that the operator can fully customize its vault as per its own design, allowing users to pick a vault based on the features that best suit the depositor.

Essentially, Vaults are completely agnostic to the staking solutions that an operator wants to run - whatever client solutions, KYC features, MEV relays or DVT middleware that the entity wants to run are under their control.

This leads to a very diverse marketplace of staking solutions that users can shop around and choose from.

Moreover, Vault Operators can set their Vault to a private setting, allowing deposits only from addresses whitelisted by the Vault Operator.

This enables use cases like solo stakers depositing ETH into their own Vault and not accepting deposits from others. For instance, compliance-sensitive organizations can create a Vault to enable staking for only a limited number of KYC'd participants.

The osETH Token is a new type of overcollateralized ETH token introduced by v3, which is a liquid ERC-20 representation of staked assets that uses Vault Token(s) as collateral. It can be minted by anyone who has staked ETH into a Vault(s), or can be bought/sold on decentralized exchanges.

Importantly, osETH represents a new type of liquid-staked ETH token that has its value pegged to staked ETH 1:1, but that does not directly pass on the slashing losses to holders, ensuring that all the staking rewards and penalties remain isolated to the individual Vault.

To ensure this, V3 requires >1 ETH for every osETH that stakers in a Vault want to mint.

In the scenario where slashing does occur, there is always a reserve of ETH that absorbs the slashing losses before osETH holders are affected. This protects osETH holders from losing their principal, making osETH a safer option for staking.

Note that the stakers who mint osETH are of the Vaults in which they staked ETH, and excess collateralization makes sure that the other osETH holders are not affected.

All you need to know about staking, delegations, and running your own Validator.

Staking offers a way for institutions and individual investors to earn rewards on their assets while still maintaining full custody of them.

Whether you're an individual investor seeking to make your assets work for you, or an institution managing a crypto treasury or providing services to clients, staking is the ideal solution.

Below, let's dive into why staking is the most important and reliable source of yield in crypto.

Or, if you prefer, you can review some information packets in the tabs below.

Let's look at a big picture conceptual overview of staking. While the finer nuances and details of the exact mechanics can vary from network to network, the core concept of Proof of Stake (otherwise referred to as PoS is generally quite similar between networks).

In a nutshell, non-custodial staking can be thought of as nearly the equivalent of depositing funds in a high yield savings account, however, with four main differences.

You retain control of your assets and your stake remains in your custody.

The base value of the asset you're staking can increase or decrease in price.

The rewards you accrue from staking are generally in the native token you staked, however, for some networks there are exceptions.

By staking, you are contributing to the overall security of the network though a mechanism known as Proof of Stake.

Staking means that holders of a specific token (the staking token) provide the token as collateral vouching for the correct and honest behavior of the validator that they delegate (stake) to.

When you stake, it involves locking away the assets in a non-custodial manner to incentivize network participants and validators to not act dishonestly. This in turn increases the security of the network via the validators, which are nodes on the network which receive the stake and verify transactions and ensure that the ledger (blockchain) is accurate and continues to move forward.

The validator is responsible for processing and verifying transactions, producing blocks and securing the blockchain, thus reaching consensus. Chorus One specializes in running validators on many different Proof of Stake networks. Ensuring you stake to a reputable validator not only helps ensure the safety of your funds but also contributes to the health and security of the network.

In return validating the network, the validator earns rewards for contributing to the overall network security and moving the blockchain forward. Thus, they earn staking rewards which are distributed to the stakers (delegators) to that validator.

This is how staking earns passive rewards on the funds you stake (delegate) to a validator. PoS (Proof of Stake) blockchains generally pay inflationary rewards as well as transaction fees as staking rewards.

The two main consensus mechanisms are Proof-of-Work (PoW) used by Bitcoin and other networks, and Proof of Stake (PoS), used by Ethereum, Solana, Cosmos, Avalanche, among others.

Proof of Work (PoW): Miners compete to solve complex math problems using powerful computers. The first to solve the problem gets to add a new block to the blockchain and earn rewards. This process uses a lot of electricity and computing power. Bitcoin uses PoW.

Proof of Stake (PoS): Validators are chosen to add new blocks based on how many delegated assets they hold and are willing to "stake" as collateral. The greater number of assets you stake, the higher your chances of being chosen to validate the next block. This method is more energy-efficient.

Staking is not the only way to earn rewards in crypto, however, it is by far one of the safest.

Let's look at some of the perks outlined below.

An overview of some best practices to keep your funds safe no matter how you store them.

Maintaining strong crypto security requires diligence across both custodial and non-custodial wallet storage methods. Below we will cover some good general practices to follow and then dive into aspects unique to both non-custodial and custodial platforms.

Feel free to jump ahead to the sections that are most relevant to you.

Enable Two-Factor Authentication (2FA)

Always activate 2FA (authenticator apps or hardware keys) for added account security when supported. Application or hardware based 2FA is more secure than SMS (text message) 2FA.

Use Strong, Unique Passwords

Create complex passwords that are unique to your wallet or account. Store them securely in a password manager.

Beware of Phishing Scams

Double-check URLs and avoid clicking on suspicious links or downloading unverified software. Only interact with trusted wallet providers.

If in doubt, run a link or file through before clicking or opening it.

Secure Your Devices

Keep your smartphone, computer, or hardware wallet updated with the latest security patches and antivirus software.

Avoid Public Wi-Fi Whenever Possible

If you must use public Wi-Fi, ensure you are connected through a reliable VPN to encrypt your connection.

Be Mindful of Social Engineering Attacks

Scammers may impersonate wallet providers or support staff. Never share sensitive details, especially your seed phrase or private keys.

When in doubt, contact the person or company through their official communication channels to verify authenticity.

Verify Transactions Carefully

Double-check wallet addresses and amounts before confirming any transaction, as blockchain transactions are irreversible.

Protect Your Seed Phrase

Write your seed phrase on paper (not stored digitally) and keep copies in separate, secure locations. Avoid taking pictures or saving it online. There are even options to store your seed phrase on steel plates.

See also:

Use Hardware Wallets for Long-Term Storage

For significant holdings, a hardware wallet provides the highest level of security by keeping private keys offline.

Multi-Sig setups are also an option in some cases, however, please contact us if you are using a Multi-Sig solution for your staking needs to ensure compatibility with the intended network.

Backups Are Critical

It is ideal to keep multiple copies of your seed phrase secured physically (i.e. never stored as a screenshot or digital file) and kept in geographically dispersed locations if possible.

If you're new to crypto, try creating a new empty wallet and restoring it to get a sense for how wallet recovery works via the wallet's seed phrase.

Separate Wallets for Different Uses

Depending on your use cases and unique situation, it can sometimes be strategic to use a hot wallet for daily transactions and a cold wallet (offline and/or a hardware wallet) for long-term storage.

Verify Wallet Authenticity

Download wallet software only from official sources to avoid malware or counterfeit apps.

This also applies to buying hardware wallets directly from the manufacturer. It is not advisable to purchase a used hardware wallet.

Choose a Reputable Provider

Use custodial wallets or exchanges with a strong security track record, regulatory compliance, and robust features that fits your needs.

Monitor Account Activity

Regularly review login attempts and transaction history for any suspicious activity.

If applicable, consult with your custodial account manager to set up their own best security practices for your account.

Enable Withdrawal Whitelisting

Some custodial wallets let you whitelist addresses, ensuring funds can only be withdrawn to specific, trusted addresses.

Stay Updated on Platform Changes

Be aware of announcements from your custodial wallet provider about updates, security breaches, or policy changes.

Feel free to reach out to our Support Team if you would like any clarification or if you encounter anyone or anything impersonating Chorus One.

Chorus One:

Everything you need to know to bridge your assets to Arbitrum

Arbitrum is a Layer 2 scaling solution for Ethereum that enhances transaction speed and reduces costs by processing transactions off-chain, while still leveraging the security of Ethereum's blockchain.

It uses a technology called Optimistic Rollups, which bundles multiple transactions together and submits them as a single batch to the Ethereum mainnet. This allows users to enjoy faster and cheaper transactions for decentralized applications (dApps), without sacrificing the decentralized security provided by Ethereum.

Bridging to Arbitrum involves transferring assets from a Layer 1 blockchain, like Ethereum, to Arbitrum, a Layer 2 scaling solution. The process requires users to interact with a bridge interface where they connect their wallet (such as MetaMask), select the token they wish to transfer, and approve the transaction. The tokens are then locked on the Layer 1 chain and represented as wrapped tokens on Arbitrum.

First, navigate to the Arbitrum bridge website found here:

Once you have navigated to the Arbitrum bridging website, you can connect a compatible wallet.

For this guide, we will be using .

If you don't yet have a MetaMask wallet, please follow the official guide from MetaMask to get started and set up your new wallet:

While MetaMask is compatible with many browsers, Chromium based browsers such as Google Chrome or Brave tend to have the best compatibility across various dApps.

Once your MetaMask or other compatible wallet is ready, connect to the Arbitrum bridge when prompted, or click on the green button in the upper-right hand corner that reads 'Connect Wallet'.

If you are prompted, or need help connecting your MetaMask wallet to the Arbitrum network, please see the following section:

After connecting your wallet, the bridge page will default to the Ethereum (ETH) asset.

It is advisable to first bridge some ETH to Arbitrum if you don't have any already, as it will be needed to pay for all gas fees on the Arbitrum network.

After this, you can bridge over any other compatible tokens you wish.

You'll see a screen similar to the screenshot below. This illustrates an example of bridging over some ETH to Arbitrum.

You can enter an amount of your choosing and see how much you will receive on Arbitrum as well as the expected gas fees involved with the transaction.

Go ahead and proceed once you have selected how much ETH you wish to bridge.

You will be prompted to sign the transaction via your MetaMask wallet (and Ledger) if you are using a hardware wallet.

Finalize your transaction and you're all set! You've now bridged your ETH to Arbitrum!

In addition to ETH, it is possible to bridge many other ERC20 tokens to Arbitrum.

You can select from the list to find what you want to bridge. In the example below, we will be using USDC.

Go ahead and approve the transaction in a similar fashion as you did for your ETH.

For some tokens, USDC being a great example of this, you will get to choose what version of the token you wish to receive on Arbitrum.

For USDC, you can choose to bridge native USDC via the Arbitrum bridge or a third party bridge

Alternatively, you can choose Wrapped USDC, known as USDC.e

Any of the options are fine, however, be sure to read the fine print on what the differences are between native and wrapped versions of your ERC20 tokens, as depending on your planned use case on Arbitrum, this differentiation may matter!

After you've initiated some bridging transactions, you will likely be prompted to view your transaction history.

It's worth noting that bridging assets to Arbitrum can take a few minutes depending on network conditions and the type of assets you are bridging.

And that's it, you'e all set! You've successfully bridged your assets to Arbitrum.

If you haven't already added Arbitrum as a network to your MetaMask wallet, you will need to in order to interact with your Arbitrum assets.

The wallet may prompt you automatically, and if so, go ahead and proceed with those prompts.

If you are not prompted, you can add the Arbitrum Network to MetaMask via the following steps.

Open your MetaMask browser wallet and click the network selection button.

Next, select Arbitrum if it appears in the list. If it does not, you can search for it via the search bar or click 'Add network' to manually enter the network information.

Go ahead and follow the prompts to switch to and connect to the Arbitrum Network.

You're all set! You've now connected to the Arbitrum network and you should see any bridged assets appearing in your wallet if the trsansactions have completed.

Everything you need to know to stake SUI to Chorus One.

Sui is a Layer 1 blockchain and smart contract platform designed to make digital asset ownership fast, private, secure, and accessible to everyone.

Developed by Mysten Labs and utilizing a unique consensus mechanism and advanced cryptographic techniques, Sui aims to support a wide range of decentralized applications (dApps) and provide a robust infrastructure for Web3 development.

Install the SUI wallet extension. In case you don’t have the SUI wallet extension installed on your browser already, visit the following link to install it.

Click on ‘Add to Chrome’ if you are using a Chrome browser or Brave if you are using the Brave browser and follow the installation instructions.

Once installed, a new page should pop up. However, if this does not happen, simply click on the extension in the Chrome/Brave toolbar and the following page will open up.

Click on 'More Options' to create your account.

You can either sign in with your Ledger if you'd like by opening up the SUI app on your device, or create a new wallet in the browser extension by selecting 'Create a new Passphrase Account'.

Create a strong password you will remember and select if you would like the wallet to auto-lock after a set period of time.